Loading

Get Al Dor Form E00 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL DoR Form E00 online

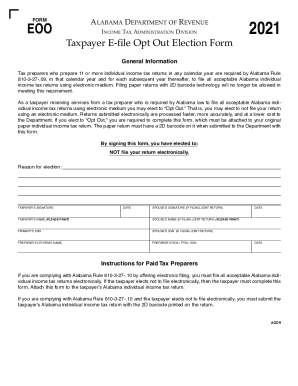

Filling out the Alabama Department of Revenue Form E00 is essential for taxpayers opting out of electronic filing. This guide provides clear instructions to help users complete the form accurately and efficiently, ensuring a smooth submission process.

Follow the steps to complete the AL DoR Form E00 online.

- Click ‘Get Form’ button to obtain the AL DoR Form E00, then open it in your preferred online editor.

- Fill in the reason for election in the designated field. This explains why you are opting out of electronic filing.

- In the taxpayer’s signature section, provide your signature, confirming your decision to opt out of electronic filing.

- If filing jointly, the spouse needs to sign in the appropriate section as well.

- Print the names of both the taxpayer and the spouse in the corresponding fields.

- Enter the primary taxpayer’s Social Security Number (SSN) and, if applicable, the spouse’s SSN in the designated areas.

- Complete the preparer’s or firm’s name, along with their Federal Employer Identification Number (FEIN), Preparer Tax Identification Number (PTIN), or Social Security Number (SSN) as required.

- Review all information for accuracy before saving the form.

- Once completed, you can choose to save changes, download, print, or share the form as needed.

Complete the AL DoR Form E00 online today to ensure your income tax return is filed properly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

FORM 20C-C Alabama Consolidated Corporate Income Tax Return. The Form 20C-C must be filed by or on behalf of the members of the Alabama affiliated group in ance with Alabama Code Section 40-18-39, when a Consolidated Filing elec- tion has been made pursuant to Code Section 40-18-39(c).

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.