Loading

Get Md Comptroller Mw506ae 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW506AE online

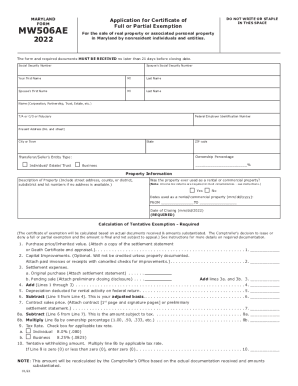

The MD Comptroller MW506AE form is essential for nonresident individuals and entities seeking a Certificate of Full or Partial Exemption from Maryland's withholding tax on the sale of real property. This guide provides a step-by-step approach to effectively complete the form online.

Follow the steps to fill out the MD Comptroller MW506AE online.

- Click ‘Get Form’ button to access the MW506AE form and open it in your preferred online editing platform.

- Begin by filling out the personal information of the transferor/seller. This includes entering your full name, Social Security Number, and whether applicable, your partner's information.

- Indicate the name of your organization (if applicable), type of entity, and your federal employer identification number.

- Provide your current address including the city, state, and ZIP code.

- Next, specify your ownership percentage in the property in question.

- Detail the property information by providing the physical address or relevant identification numbers used by the State Department of Assessments and Taxation.

- Respond to whether the property was ever utilized as rental or commercial property, and if applicable, provide the dates of such use.

- Carefully complete the calculation of tentative exemption section. You will need the purchase price or inherited value, capital improvements, and settlement expenses.

- After calculating the tentative withholding amount using the appropriate tax rate, ensure all necessary attachments and documentation are included.

- Finally, sign and date the form along with your partner if applicable, and provide contact information for follow-up.

Complete your MW506AE form online and ensure your submission is thorough and timely for successful processing.

You are required to fill out a MW506 form on an accelerated, monthly, quarterly, seasonal or annual basis, depending upon the amount of tax withheld. You must file your MW506 form by the due dates, even if no tax was withheld. If no tax is due, file by telephone by calling 410-260-7225.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.