Loading

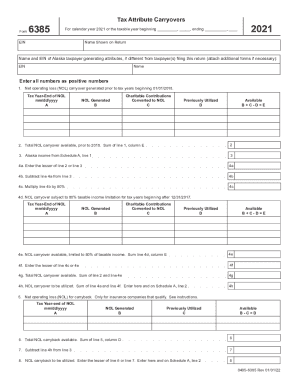

Get Pdf Instructions For Form 6385 Tax Attributes Carryovers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PDF Instructions For Form 6385 Tax Attributes Carryovers online

This guide provides a clear and concise overview of how to complete the PDF Instructions For Form 6385 Tax Attributes Carryovers online. By following these steps, users can efficiently fill out the necessary fields to ensure accurate reporting of tax attributes.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred PDF editing tool.

- Enter your employer identification number (EIN) at the top of the form.

- Fill in your name as it appears on your tax return.

- If applicable, provide the EIN and name of the Alaska taxpayer generating attributes in the designated fields.

- Complete the section for net operating loss (NOL) carryover. Enter positive numbers for each calculation: determine the NOL generated, previously utilized, and available amounts across the relevant lines.

- Calculate the total NOL carryover available prior to 2018 by summing the available amounts from the previous lines.

- Input Alaska income from Schedule A, line 1 as required.

- Determine the lesser amount between line 2 and line 3, and enter that figure in line 4a.

- Subtract the value in line 4a from line 3 and record this result in line 4b.

- Multiply the amount in line 4b by 80% and enter this in line 4c.

- Complete the NOL carryover section for tax years beginning after December 31, 2017.

- Follow the calculations for lines 4d to 4h to arrive at your total NOL carryover available.

- Calculate unused capital loss carryover and complete the relevant sections for both carryover and carryback.

- Proceed through each subsequent section for excess charitable contributions and AMT previously paid, inputting figures where necessary.

- Finally, review all entries for accuracy. Save your changes, and download or print the completed form for your records.

Complete your Form 6385 online to ensure your tax attributes are accurately reported.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.