Loading

Get Ma Schedule Ec 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule EC online

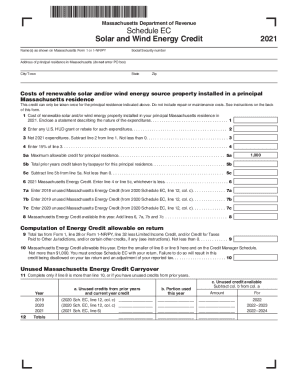

Filling out the MA Schedule EC is an essential step for individuals seeking to claim the Solar and Wind Energy Credit for their principal residence in Massachusetts. This guide will provide you with clear, step-by-step instructions to help you complete the form effectively.

Follow the steps to fill out the MA Schedule EC online

- Press the ‘Get Form’ button to access the MA Schedule EC form and open it in your preferred editor.

- Begin by entering your name(s) as they appear on Massachusetts Form 1 or 1-NR/PY.

- Input your Social Security number in the designated field.

- Provide the address of your principal residence in Massachusetts. Note that PO boxes are not acceptable.

- State your city or town, followed by your state and zip code.

- On line 1, enter the total cost of the renewable solar and/or wind energy source property installed at your principal residence in 2021. Be sure to include a statement describing the nature of the expenditures.

- For line 2, enter any U.S. HUD grant or rebate received for the expenditures related to the renewable energy property.

- Calculate your net 2021 expenditures by subtracting the amount on line 2 from line 1 and enter the result on line 3.

- On line 4, calculate 15% of the amount shown on line 3.

- Enter the maximum allowable credit for your principal residence on line 5a, which is capped at $1,000.

- For line 5b, enter the total prior years' credit taken for this principal residence.

- To find your available credit, subtract line 5b from line 5a and enter the result on line 5c.

- On line 6, enter the 2021 Massachusetts Energy Credit, which is the lesser of line 4 or line 5c.

- If applicable, enter any unused Massachusetts Energy Credit from previous years in lines 7a, 7b, and 7c.

- Calculate the total Massachusetts Energy Credit available this year by adding lines 6, 7a, 7b, and 7c.

- Complete lines 9 through 10 to compute the energy credit allowable and final adjustments.

- If you have more than one principal residence that qualified for the Energy Credit, ensure to file a separate Schedule EC for each, keeping in mind the $1,000 maximum limit.

- Finally, save your changes, download, print, or share the completed form as needed.

Take the next step and complete your MA Schedule EC online today.

The installation of the system must be complete during the tax year . Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2022-2032.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.