Loading

Get Ma Dor M-8379_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR M-8379_DSA online

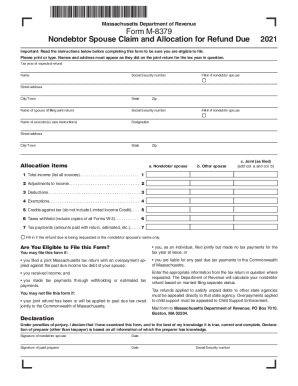

The Massachusetts Department of Revenue M-8379_DSA form is essential for nondebtor spouses seeking refunds. This guide provides a clear, step-by-step approach to completing the form online, ensuring all necessary details are accurately filled out.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the M-8379_DSA form and open it in your preferred editor.

- Enter the tax year for which you expect a refund in the designated field. Ensure that this matches the tax year of your joint return.

- Fill in the name and social security number of the nondebtor spouse. Ensure that the information matches exactly as it appeared on the joint return.

- Complete the address fields, including street address, city or town, state, and zip code for the nondebtor spouse.

- If filing a joint return, enter the name and social security number of the spouse.

- Provide the name of the executor(s) if applicable and fill out the designation section accurately.

- Refer to the allocation items section and fill in the appropriate income details. Elaborate on sources of income in the total income section, ensuring all sources are listed.

- Fill in adjustments to income, claim deductions, and exemptions as necessary. Be sure all figures are accurate and reflect the joint return.

- Complete the credits against tax section while ensuring not to include any limited income credits. Enter taxes withheld and tax payments made.

- If requesting the refund solely in the nondebtor spouse’s name, indicate this where required.

- Review your entries for accuracy. Sign the form where indicated, including the date. If there was a paid preparer involved, ensure they also sign and provide their social security number.

- Once completed, save your changes. You can download, print, or share the form as needed.

Ensure a seamless experience by completing the MA DoR M-8379_DSA form online.

Massachusetts currently has the lowest estate tax exemption in the nation at $1 million, the 2022 proposal called for doubling the exemption to $2 million. It also called for the elimination of the fiscal cliff. Both changes would make Massachusetts' estate tax slightly less onerous.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.