Loading

Get Ma Form 1_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Form 1_DSA online

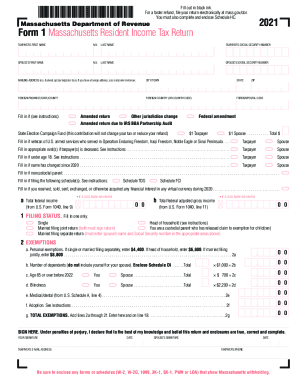

Filling out the MA Form 1_DSA is a crucial step for taxpayers in Massachusetts to accurately report their income and claim any eligible deductions. This guide provides clear, step-by-step instructions for completing the form online, ensuring that all users can navigate the process with ease.

Follow the steps to fill out the MA Form 1_DSA online.

- Press the ‘Get Form’ button to download the MA Form 1_DSA and open it in your preferred editor.

- Enter the taxpayer's first name, middle initial, and last name in the designated fields. Be sure to provide the correct social security number.

- If applicable, fill in the spouse's first name, middle initial, and last name, along with their social security number.

- Input the mailing address, including street number, apartment or suite, city or town, and ZIP code. If you have a foreign address, complete the additional fields for foreign province/state/county, postal code, and country.

- Indicate whether this is an amended return, and select any relevant options regarding jurisdiction changes. Specify contributions to the state election campaign fund if desired.

- Fill in the filing status by selecting one option: single, head of household, married filing jointly, or married filing separately. Ensure the correct selection based on your circumstances.

- Complete the exemptions section by entering personal exemptions and details about any dependents, along with information relevant to age, blindness, and other qualifying factors.

- Report your income, including wages, pensions, bank interest, and any other income types. Make sure to enclose any necessary schedules as specified.

- List total deductions based on the specified guidelines and instructions and calculate total income after deductions.

- Fill out the tax calculation section accurately, considering the applicable tax rates and including any credits.

- Double-check all entries for accuracy, then either save changes, download the completed form, print a copy for your records, or share it as needed.

Complete and submit your MA Form 1_DSA online to ensure timely processing and refunds.

“If you're working from home, you're going to be taxed in your home state — unless the state where you used to work wants to get aggressive with you.” One especially high-profile fight took place between Massachusetts and New Hampshire. (New Hampshire is one of the nine states that charges no state income tax.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.