Loading

Get Irs 1040 Tax Table_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Tax Table_DSA online

This guide provides a comprehensive overview of how to complete the IRS 1040 Tax Table_DSA online. It aims to assist users of all experience levels in effectively filling out the necessary fields and sections of the form.

Follow the steps to complete the IRS 1040 Tax Table_DSA online.

- Use the 'Get Form' button to access the IRS 1040 Tax Table_DSA and open it in your online document editor.

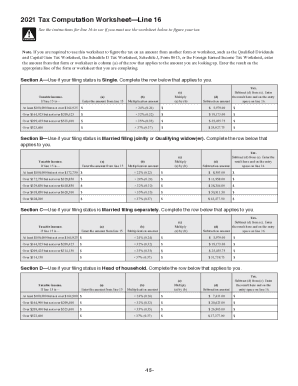

- Locate the 2021 Tax Table section within the form. This section outlines the taxable income amounts and their corresponding tax liabilities based on filing status.

- Identify and enter your taxable income as indicated on your Form 1040, line 15. This is crucial for determining your tax amount correctly.

- Match your taxable income with the appropriate income range provided in the Tax Table. Ensure you are looking at the correct column for your filing status: Single, Married Filing Jointly, Married Filing Separately, or Head of Household.

- Find the tax amount that corresponds with your taxable income and filing status. Enter this amount into the designated entry space on your Form 1040, line 16.

- If applicable, refer to the Earned Income Credit (EIC) Table that follows the Tax Table to determine if you qualify for the credit based on your income and number of qualifying children.

- Once you have filled out the necessary sections, ensure all information is correct and save your changes.

- Download or print the completed document as needed, or share it directly with the necessary parties.

Take proactive steps in managing your tax filings by completing the IRS 1040 Tax Table_DSA online today.

Taking the standard deduction might be easier, but if your total itemized deductions are greater than the standard deduction available for your filing status, saving receipts and tallying those expenses can result in a lower tax bill.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.