Loading

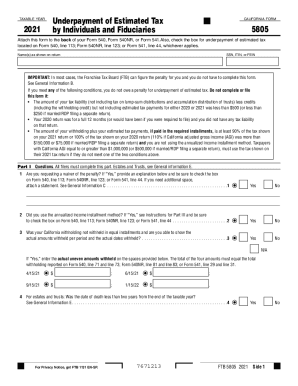

Get 2021 Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries. 2021 Form 5805

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2021 Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries online

Filling out the 2021 Form 5805 is an essential task for individuals and fiduciaries who may need to report an underpayment of estimated taxes. This guide will walk you through each section of the form, providing clear instructions to ensure accuracy and compliance.

Follow the steps to successfully complete your 2021 Form 5805.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name(s) as shown on your tax return and enter your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Federal Employer Identification Number (FEIN).

- Review the important note indicating that, in most cases, the Franchise Tax Board can calculate the penalty for you and you may not need to fill out the form.

- In Part I, answer the initial questions about whether you are requesting a waiver of the penalty and if you used the annualized income installment method. For each question, check 'Yes' or 'No' accordingly.

- In Part II, enter your current year tax after credits on line 1. Then calculate 90% of this amount for line 2.

- On line 3, enter the withholding taxes you've paid and subtract this amount from line 1 on line 4. If this amount is less than $500 (or less than $250 for married/RDP filing separately), stop here as you do not owe a penalty.

- Next, on line 5, enter the tax amount from your 2020 tax return, considering any adjustments based on your filing status, and find your required annual payment on line 6.

- Proceed to calculate if you can use the short method or if you should refer to Worksheet II based on your responses in Part I.

- If using the short method, complete lines 7 through 10, leading to your total underpayment for the year on line 10.

- Calculate the penalty on line 13, which you will report on your related tax form. Make sure to check the applicable box on Form 540, Form 540NR, or Form 541.

- If applicable, complete Part III by providing details regarding your income throughout the year, only if you had irregular income. Follow the specific directions for annualizing your income for accurate penalty calculations.

- Review all filled sections for accuracy, and ensure you save any changes made. Finally, download, print, or share the completed form as necessary.

Complete your documents online to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.