Loading

Get Ca Ftb 590_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 590_DSA online

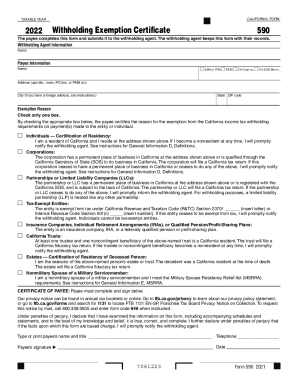

Filling out the CA FTB 590_DSA form is essential for individuals and entities seeking exemption from California income tax withholding. This guide provides clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to fill out the CA FTB 590_DSA form online.

- Press the ‘Get Form’ button to access the CA FTB 590_DSA form and open it for editing.

- Enter the taxable year at the top of the form, ensuring that the year corresponds to the relevant tax year for your submissions.

- Complete the withholding agent information section. Provide the name of the withholding agent who will keep this form for their records.

- Fill out the payee information. Indicate whether the payee is using a Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), Federal Employer Identification Number (FEIN), California Corporation number, or California Secretary of State (SOS) file number. Provide the payee's name, address (including apartment or suite number if applicable), city, state, and ZIP code.

- Select the exemption reason by checking the appropriate box that certifies the payee's reason for being exempt from California income tax withholding. Be sure to review the definitions to ensure the correct selection.

- Confirm residency status if claiming residency as an individual by checking the box attesting that they are a resident of California.

- Complete the certification statement by providing the payee's name, title, and a telephone number. The payee must sign and date the form to confirm that the information is accurate and complete, and to acknowledge the obligation to notify the withholding agent of any changes.

- Review the completed form for accuracy and necessary signatures. Once finalized, users may save the changes, download, print, or share the form as needed.

Start filling out your CA FTB 590_DSA form online today!

Use Form 590, Withholding Exemption Certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. For more information, go to ftb.ca.gov and search for backup withholding. Form 590 does not apply to payments for wages to employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.