Loading

Get Generate And Send Customized Year-end Tax Statements/receipts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Generate And Send Customized Year-end Tax Statements/receipts online

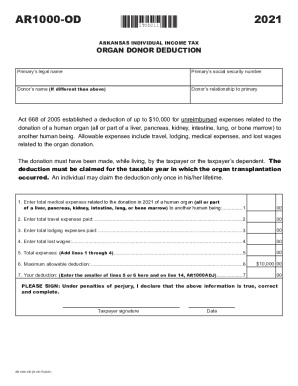

Filling out the Generate And Send Customized Year-end Tax Statements/receipts can seem daunting, but with this guide, you'll find the process straightforward and manageable. This document is essential for users looking to document organ donor deductions for tax purposes.

Follow the steps to accurately complete your tax statements online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the primary’s legal name in the designated field. Ensure that the name matches the name associated with the social security number provided.

- Enter the primary’s social security number. Double-check for accuracy to avoid any discrepancies that could affect your tax filing.

- If the donor’s name differs from the primary’s, input the donor’s name in the corresponding field.

- Indicate the donor’s relationship to the primary. This information is vital for clarifying the connection regarding the donation.

- Record total medical expenses associated with the organ donation in the year 2021 in line 1. Include only unreimbursed expenses.

- Enter the total travel expenses incurred for the donation in line 2. Be thorough to ensure all related travel costs are accounted for.

- In line 3, provide the total lodging expenses related to the organ donation. Again, be careful to capture all applicable costs.

- Fill in line 4 with the total amount of lost wages due to the organ donation.

- Calculate the total expenses by adding the amounts from lines 1 through 4 and enter this sum in line 5.

- The maximum allowable deduction is pre-populated in line 6 as $10,000. Confirm this amount, as it reflects the cap for deductions related to organ donation.

- In line 7, enter the smaller amount between the total expenses in line 5 and the maximum allowable deduction in line 6. This amount should also be recorded on line 14 of form AR1000ADJ.

- Finally, ensure you provide your signature and the date, confirming that all information is true, correct, and complete under penalties of perjury.

Now that you know how to navigate the form, complete your documents online with confidence.

Related links form

The year-end donor receipt is a summary of how much a specific donor has contributed to your organization. It includes an email message as well as a summary of donations in an attached PDF file. Make sure to have all your organization information accurate and complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.