Loading

Get Ar Ar2210 2020-2022 - Fill And Sign Printable Template ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

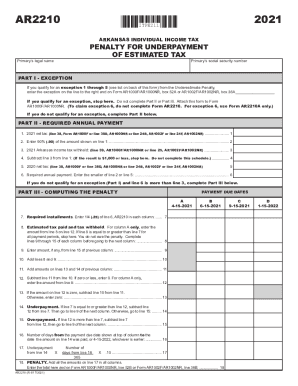

How to use or fill out the AR AR2210 2020-2022 - Fill And Sign Printable Template online

Filling out the AR AR2210 form online can seem daunting, but with the right guidance, you can navigate it easily. This guide provides step-by-step instructions to help you accurately complete the form.

Follow the steps to fill out the AR AR2210 form online efficiently.

- Press the ‘Get Form’ button to access the AR AR2210 form and open it in your preferred online editor.

- Begin by entering your legal name in the designated field labeled 'Primary’s legal name'. Ensure that all information matches the documents you are submitting.

- Input your social security number in the field for 'Primary’s social security number', ensuring it is entered correctly to avoid any processing delays.

- Proceed to Part I - Exception. If you qualify for an exception from the penalty for underpayment, enter the appropriate exception number and do not complete Part II or Part III.

- If you do not qualify for an exception, move to Part II - Required Annual Payment. Follow the lines sequentially, entering your 2021 net tax amount on line 1.

- Calculate and enter 90% of the amount shown on line 1 into line 2.

- Input your 2021 Arkansas income tax withheld amount on line 3.

- Complete line 4 by subtracting the amount from line 3 from line 1. If the result is $1,000 or less, you do not need to continue past this line.

- If line 6 exceeds line 3, fill out Part III. Begin this section by entering the necessary values into each required column as described in the instructions.

- When you finish filling out the form, review all entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Start completing your forms online today to ensure timely submission!

Arkansas Tax Extension Form: To request an Arkansas-only extension, file Form AR1055 by the original due date of your return. Arkansas Extension Payment Requirement: An extension of time to file is not an extension of time to pay your Arkansas income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.