Loading

Get Ny Nys-45-att-mn_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY NYS-45-ATT-MN_DSA online

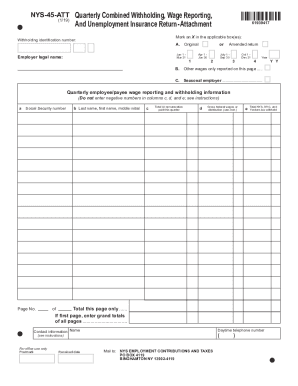

Filling out the NYS-45-ATT-MN_DSA form online is crucial for employers to report wage information and withholding taxes accurately. This guide will walk you through the process step by step, ensuring that you complete the form correctly and efficiently.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by marking an 'X' in the applicable box to indicate whether you are submitting an original or amended return, and select the relevant quarter for the reporting period.

- Provide your withholding identification number, along with the legal name of your business in the designated fields.

- Fill in the sections for wages reported on this page, indicating if you are a seasonal employer, if applicable.

- Complete the quarterly employee/payee wage reporting section, ensuring to fill in social security numbers, names, and wages accurately. Remember not to enter negative numbers in specific columns as per the instructions.

- If this is the first page of your submission, enter the grand totals for each applicable category from all pages included.

- Provide your contact information including your name and daytime telephone number for any necessary follow-up.

- Before final submission, ensure to review all entered information for accuracy. Once verified, you can save changes, download, or print the completed form.

Complete your documents online today for a seamless filing experience.

Exemption from New York State and New York City withholding You must be under age 18, or over age 65, or a full-time student under age 25 and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.