Loading

Get Ny Dtf It-2664 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-2664 online

Filling out the NY DTF IT-2664 form can seem daunting, but with clear guidance, you can complete it efficiently online. This guide provides comprehensive steps to help you navigate each section of the form with ease.

Follow the steps to fill out the NY DTF IT-2664 form online.

- Press the ‘Get Form’ button to access the IT-2664 form online and open it in your preferred editor.

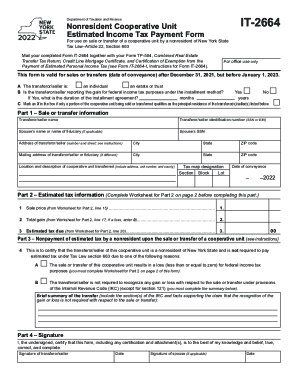

- Begin by entering the transferor/seller information in Part 1, including the name, identification number, and address details. If applicable, also provide the spouse's information.

- Indicate whether the transferor/seller is reporting gain under the installment method. If so, specify the duration of the installment agreement in months or years.

- Provide information on the cooperative unit being sold. Include the address, unit number, county, date of conveyance, and tax map designation.

- Proceed to Part 2 to fill out the estimated tax information. First, complete the Worksheet for Part 2 on page 2, which assists in calculating the sale price and gain.

- Input the sale price, total gain, and estimated tax due as derived from the worksheet. Make sure to use accurate figures as this impacts the estimated tax calculation significantly.

- In Part 3, certify if the transferor/seller is a nonresident and not required to pay estimated tax due to specific reasons, such as the sale resulting in a loss.

- In Part 4, sign and date the form. If applicable, ensure that the spouse also signs the document.

- Once completed, save the changes to the form. You can then download, print, or share the document as needed.

Complete your documents online now for a smoother filing process.

Using black or blue ink, make your check or money order payable to the “Franchise Tax Board.” Write your social security number or individual taxpayer identification number and “2022 Form 540-ES” on it. Mail this form and your check or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0008.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.