Loading

Get Summary Of Federal Form 1099-r Statements - Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Summary Of Federal Form 1099-R Statements - Department Of ... online

This guide provides you with straightforward instructions on how to complete the Summary Of Federal Form 1099-R Statements online. By following these steps, you can ensure that your form is filled out accurately and submitted correctly.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to access the form and open it in your online editor.

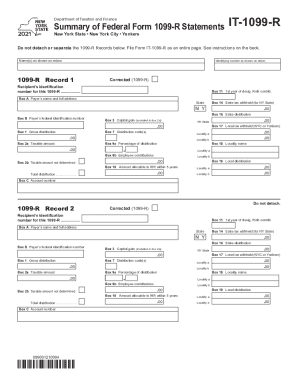

- Begin by entering the name(s) as shown on your tax return. Ensure to include the full 9-digit Social Security number or employer identification number associated with your return.

- For each 1099-R Record section, input the payer's name and address in Box A, and their federal identification number in Box B.

- In Box 1, enter the gross distribution amount. For Box 2a, input the taxable amount from your records. Follow the rounding rules provided in the instructions.

- If applicable, mark an ‘X’ in the Corrected (1099-R) box if you are dealing with a corrected form. Continue filling out Boxes 3, 7, 9a, and state/locality boxes as needed.

- Complete each additional field according to the instructions provided, ensuring accuracy in the amounts and codes.

- Once all sections are filled out, review the information for accuracy and completeness. You may then save any changes made, download, print, or share the completed form as necessary.

Start completing your documents online today for a more efficient filing process.

Box 7 is the distribution code that identifies the type of distribution received. The following are the codes and their definitions: 1 - Early distribution, no known exception (in most cases under age 59 1/2) 2 - Early distribution, exception applies (under age 59 1/2) 3 - Disability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.