Loading

Get Ny Dtf It-2 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-2 online

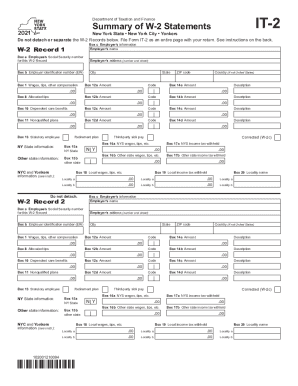

This guide provides a clear overview of the NY DTF IT-2 form, which summarizes W-2 statements for New York State income tax purposes. Follow this step-by-step instruction to complete the form accurately and efficiently.

Follow the steps to fill out the NY DTF IT-2 online:

- Press the ‘Get Form’ button to access the form and open it in an editable format.

- Locate Box c, which contains the employer's information. Enter the employer's name and address exactly as it appears on your W-2.

- In W-2 Record 1, enter the employee’s Social Security number in Box a.

- Enter the wages, tips, and other compensation in Box 1 as provided on your federal W-2.

- Input any allocated tips in Box 8, dependent care benefits in Box 10, and mark the statutory employee box if applicable in Box 13.

- For Box 12a through 12d, enter the corresponding amounts and codes from your W-2. If there are additional items, complete a new W-2 Record section as needed.

- Check the corrected (W-2c) box if applicable, and fill out the corrected information.

- In Boxes 16a and 17a, enter the New York State wages and income tax withheld as shown on your federal W-2.

- Complete Boxes 15b through 17b for any other state wages and withholding.

- For local taxes incurred in NYC or Yonkers, fill in Boxes 18 through 20 as necessary.

- Once all fields are accurately filled, save your changes, download the form, print it, or share it as required.

Start completing your NY DTF IT-2 form online to ensure accurate filing.

The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201; both spouses' income will be taxed as full-year residents of New York State.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.