Loading

Get Ct Tpg-138_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT TPG-138_DSA online

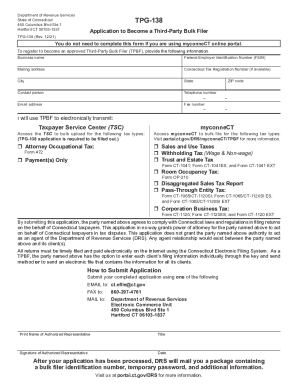

The CT TPG-138_DSA, known as the application to become a third-party bulk filer, is a crucial document for businesses looking to file taxes on behalf of others in Connecticut. This guide provides clear, step-by-step instructions on how to complete the form correctly and efficiently online.

Follow the steps to successfully complete the CT TPG-138_DSA

- Click the ‘Get Form’ button to obtain the CT TPG-138_DSA and open it in the editing interface.

- Begin by entering your business name in the specified field. Ensure that you provide the official name under which your business operates.

- Input your Federal Employer Identification Number (FEIN). This number is essential for identifying your business for federal tax purposes.

- Fill in the mailing address of your business, including the city, state, and ZIP code. This information will be used for official communications.

- Provide your Connecticut Tax Registration Number, if available. This will assist in verifying your business registration within the state.

- Identify a contact person for your application. This should be someone who can answer questions or provide information about the application.

- Enter the telephone number of the contact person, including the area code, a fax number, and an email address to facilitate communication.

- Indicate which services you will use for electronic transmission by checking the appropriate boxes for the tax types: Attorney Occupational Tax, Sales and Use Taxes, Withholding Tax, and others specified.

- Review the declaration statement, which states your agreement to comply with Connecticut laws regarding tax filing.

- Record the name, title, signature, and the date from the authorized representative who will submit the application.

- After completing the form, you can save your changes. Options to download, print, or share the form are also available.

Complete your CT TPG-138_DSA online today to ensure a smooth filing process.

The percentage method is used if your bonus comes in a separate check from your regular paycheck. Your employer withholds a flat 22% (or 37% if over $1 million). This percentage method is also used for other supplemental income such as severance pay, commissions, overtime, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.