Loading

Get Instructions For Form It-213 "claim For Empire State Child ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for form IT-213 "Claim for Empire State Child Credit" online

Filling out the Instructions for Form IT-213, which is essential for claiming the Empire State Child Credit, can be straightforward when you understand the required steps. This guide will provide you with clear and detailed instructions to help you complete the form online with confidence.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to obtain the form and open it in the designated editor.

- Determine your eligibility by completing lines 1 through 5. For line 3, use your NY recomputed federal adjusted gross income from Form IT-201, line 19a. Enter the number of qualifying children for line 4 according to the criteria mentioned in the instructions. Make sure you do not include children claimed by a noncustodial parent on line 4. For line 5, only include children who are at least four but less than 17 years old.

- Enter the required information for each qualifying child on line 6, including their name (with suffix), Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and date of birth. If you have more than six children, provide additional details on Form IT-213-ATT.

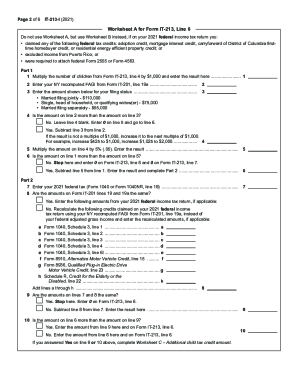

- Compute your credit using the provided worksheets. For line 6, utilize Worksheet A or B based on your previous federal tax filings. Ensure you follow the specific instructions for each worksheet precisely to arrive at the correct credit amount.

- If applicable, finish completing any remaining steps outlined in the instructions, such as entering specific financial details and determining your total credit. Review all entries thoroughly to ensure accuracy.

- Once all required fields are complete, save your changes, and you can choose to download, print, or share the completed form as required.

Complete your documents online to take advantage of the Empire State Child Credit.

Empire State Child Credit To claim the Empire State credit the tax filer must file form IT-213 along with the New York State income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.