Loading

Get Nyc Dof Att-s-corp 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF ATT-S-CORP online

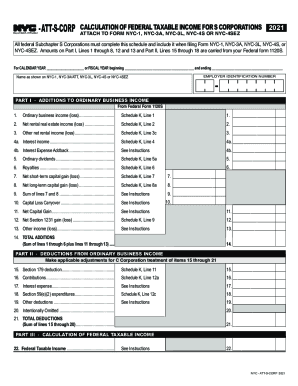

The NYC DoF ATT-S-CORP is an essential form for all federal Subchapter S Corporations that need to calculate their federal taxable income. This comprehensive guide will provide you with clear, step-by-step instructions on filling out the online form effectively and accurately.

Follow the steps to complete the NYC DoF ATT-S-CORP form online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Fill in the calendar year or fiscal year details at the top of the form, ensuring to indicate the appropriate dates.

- Enter your name as shown on the relevant NYC forms—NYC-1, NYC-3A/ATT, NYC-3L, NYC-4S, or NYC-4SEZ.

- Input your employer identification number in the designated field, as this is crucial for identification.

- Complete Part I by entering the additions to ordinary business income based on the information from your Federal Form 1120S. This includes lines for ordinary business income, net rental income, interest income, and other relevant categories.

- In Part II, calculate the deductions from ordinary business income, filling in each line carefully according to the guidelines, including entries for Section 179 deductions and contributions.

- Proceed to Part III to calculate your federal taxable income by subtracting the total deductions from your total additions.

- Review all entries for accuracy and completeness. It is critical to ensure that all fields reflect the correct information.

- Once you have filled out the form, you can save your changes, download a copy, print it out, or share the completed form as needed.

Start filling out your NYC DoF ATT-S-CORP form online today to ensure compliance and accuracy.

Entire net income base — 8.85 percent of entire net income. Total capital base — 0.15 percent of business and investment capital. There are numerous variables to consider with this method.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.