Get Sba 4-l 2000-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 4-L online

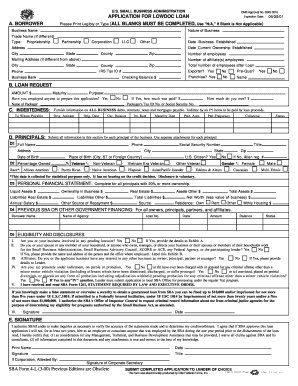

The SBA 4-L form is crucial for businesses applying for low-doc loans through the Small Business Administration. This guide provides a step-by-step approach to completing the form online, ensuring that you can submit a complete and accurate application with confidence.

Follow the steps to effectively complete the SBA 4-L form online.

- Click ‘Get Form’ button to retrieve the SBA 4-L document and open it for editing.

- In Section A, enter the business name, nature of business, and trade name if applicable. Select the business type (e.g., proprietorship, partnership, etc.) and fill in the establishment dates, address, and contact details.

- Complete the employee information by providing the number of employees, including affiliates, and the expected total after the loan.

- In Section B, input the amount requested for the loan, specify the maturity period, and describe the loan's purpose. Indicate whether a packager was employed for the application.

- For Section C, list all business debts and provide the required details for each debt, marking items to be paid with loan proceeds.

- Section D requires information on all principals of the business. Complete separate attachments for each principal, providing details such as ownership percentage, race, and citizenship status.

- Complete the personal financial statement for all principals owning 20% or more of the business, detailing assets, liabilities, and net worth.

- In Section E, complete the signature area, affirming the application's accuracy and authorizing SBA inquiries.

- For Section F, fill in the lender's name, address, and contact details as well as the loan terms in Section G accurately.

- In Sections H and I, provide the necessary financial statements and lender comments as required, ensuring accuracy and consistency.

- Finally, review all sections for completeness, save your progress, download or print as necessary, and then submit the form to your chosen lender.

Prepare and complete your SBA 4-L application online today to take the next step in securing your business financing.

The down payment for SBA 504 loans usually ranges from 10% to 20%, depending on the type of business and project. For example, businesses purchasing existing buildings may qualify for a lower down payment than those constructing new facilities. Understanding these percentages can help you plan your finances better. US Legal Forms offers detailed information on the SBA 4-L program, ensuring you know the exact requirements before applying.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.