Loading

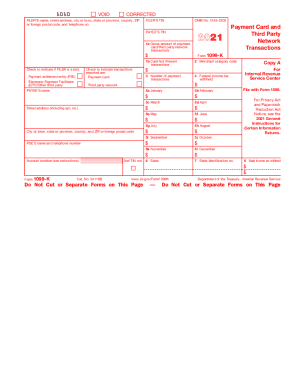

Get Irs 1099-k 2021

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-K online

Filling out the IRS 1099-K form can be straightforward with the right guidance. This guide will help you navigate the online completion of the form, ensuring you accurately report the necessary financial information.

Follow the steps to complete the IRS 1099-K form online.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Fill in the FILER’s name and address. This should include the street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number.

- Enter the FILER’s TIN. This is the Taxpayer Identification Number required for the form.

- Provide the PAYEE’S TIN in the designated field.

- Report the gross amount of payment card/third party network transactions in Box 1a. This is the total amount processed over the calendar year.

- If applicable, check the box for Card Not Present transactions in Box 1b, and select whether the FILER is a payment settlement entity or electronic payment facilitator.

- Indicate the merchant category code in Box 2.

- Document the number of payment transactions in Box 3.

- If applicable, enter any federal income tax withheld in Box 4.

- Fill out Boxes 5a to 5l to report the transaction amounts for each month, from January to December.

- If there are any state-level details, include the state in Box 6, state identification number in Box 7, and any state income tax withheld in Box 8.

- Once all fields are filled out accurately, save changes, and consider downloading, printing, or sharing the form as necessary.

Complete your IRS 1099-K form online today for accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Whether you own a business, are self-employed, work in the gig economy or are selling personal items, Form 1099-K includes the gross amount of all payment transactions. You may receive a Form 1099-K from each payment settlement entity from which you received payments in settlement of reportable payment transactions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.