Loading

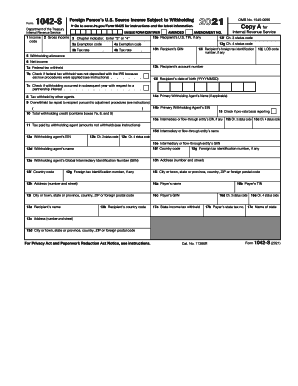

Get Irs 1042-s 2021

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1042-S online

The IRS 1042-S form is designed for reporting income paid to foreign persons that is subject to U.S. withholding tax. This guide will provide clear and supportive instructions to help you accurately complete this form online.

Follow the steps to fill out the IRS 1042-S form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the top section, enter the unique form identifier if applicable. If this is an amended return, indicate this by checking the amendment box.

- Locate box 1 and enter the income code that corresponds to the type of income being reported. Refer to the explanation of codes for accurate classification.

- In box 2, enter the gross income amount paid to the recipient within the tax year.

- In boxes 3 and 4, enter the chapter indicator and exemption code. Select '3' or '4' for chapter indicator and provide the relevant exemption code if available.

- Fill out the recipient's details: their name, address, and U.S. TIN if applicable, in boxes 13a to 13d.

- In box 7a, input the total federal tax withheld. This is critical for reporting the withholding tax.

- Complete boxes 15a to 15e if you have intermediary or flow-through entities involved. Ensure all related status codes are filled accurately.

- Once all sections are completed, save changes. You can download, print, or share the completed form for your records.

Complete your IRS 1042-S form online today to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Forms 1042, 1042-S and 1042-T must be filed by March 15 of the year following the calendar year in which the income subject to reporting was paid. If March 15 falls on a Saturday, Sunday, or legal holiday, the due date is the next business day.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.