Loading

Get Irs 944 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 944 online

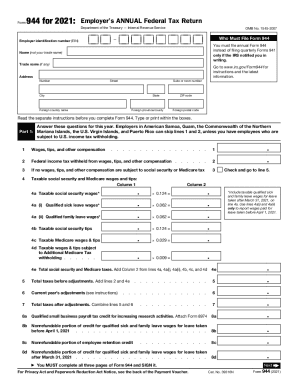

The IRS Form 944 is designed for eligible employers to report their annual federal tax returns. This guide provides a clear and supportive approach to completing the form online, ensuring all necessary details are filled accurately.

Follow the steps to accurately complete Form 944 online.

- Use the ‘Get Form’ button to obtain the IRS 944 form and open it in your preferred digital editing tool.

- Enter your employer identification number (EIN) in the designated field. This is crucial as it identifies your business with the IRS.

- Fill in your name as the employer and, if applicable, the trade name of your business.

- Provide your business address, including the street number, city, state, ZIP code, and any foreign information if applicable.

- Answer the preliminary questions for this tax year to determine your filing eligibility. This includes providing total wages, tips, and other compensation.

- Calculate federal income tax withheld from wages and enter this amount in the appropriate field.

- If applicable, indicate if there are no wages subject to social security or Medicare tax, and proceed to indicate taxable social security and Medicare wages.

- Complete the sections that require calculations for social security and Medicare taxes, entering values as necessary.

- Add total taxes before adjustments, incorporating federal income tax withheld and calculated social security/Medicare amounts.

- Include any current year’s adjustments as indicated in the instructions to arrive at total taxes after adjustments.

- Fill out the portions concerning deposits and refundable credits, ensuring all amounts align with your records.

- Confirm all information is correctly filled in, scroll through each page for completeness, and remember to sign the form as required.

- Once finalized, you can save changes to the document, download, print, or share it as needed.

Complete your IRS 944 form online today for a seamless filing experience.

Related links form

Form 944 is designed so the smallest employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.