Loading

Get Irs 8606_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8606_DSA online

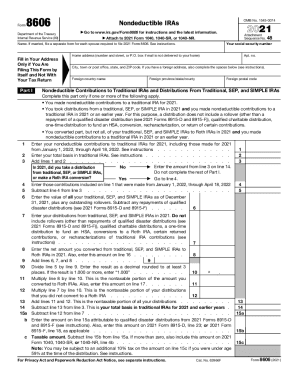

The IRS 8606_DSA form allows users to report nondeductible contributions to traditional IRAs and their distributions. This guide provides a clear set of instructions on filling out this form online, ensuring you complete it accurately and efficiently.

Follow the steps to complete the IRS 8606_DSA online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Input your social security number in the designated field. This is essential for identification purposes.

- Enter your name. If you are married, each spouse must file a separate form.

- Provide your address only if you are filing this form independently and not with your tax return.

- In Part I, detail your nondeductible contributions to traditional IRAs for the specific tax year. Include any contributions made from January 1 to April 18 of the following year.

- Fill in your basis in traditional IRAs as directed, and sum your nondeductible contributions with your basis.

- Indicate whether you took any distributions from traditional, SEP, or SIMPLE IRAs during the year. If yes, complete the relevant lines based on your distributions.

- Continue filling out the calculations based on the worksheet provided in the form to determine the nontaxable portions.

- Complete Part II if you converted any funds to a Roth IRA. This part requires that you detail the amounts converted and basis related to those conversions.

- If you took distributions from Roth IRAs, address Part III, detailing your nonqualified distributions and any related calculations.

- Finally, review all provided information for accuracy. Once complete, you can save your changes, download, print, or share the form as needed.

Start filling out the IRS 8606_DSA online today to ensure compliance with your reporting obligations.

Failure to file Form 8606 for a distribution could result in the IRA owner (or beneficiary) paying income tax and the additional 10% early distribution penalty tax on amounts that should be tax free.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.