Loading

Get Irs 1041 - Schedule D_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule D_DSA online

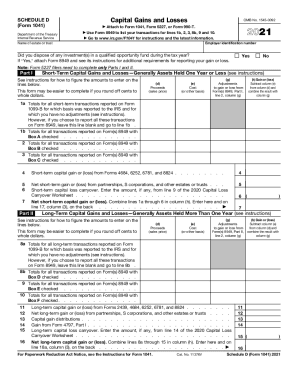

Filling out the IRS 1041 - Schedule D_DSA can seem daunting, but with a clear understanding of its components, you can complete it efficiently. This guide provides step-by-step instructions for users of all experience levels to accurately prepare this essential tax document.

Follow the steps to complete the IRS 1041 - Schedule D_DSA online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering the employer identification number and the name of the estate or trust at the top of the form.

- Indicate whether you disposed of any investments in a qualified opportunity fund during the tax year by checking 'Yes' or 'No'. If 'Yes', ensure to attach Form 8949 as instructed.

- Proceed to Part I for short-term capital gains and losses. Enter the details of your short-term transactions, including proceeds, adjustments to gain or loss, cost, and the resulting gain or loss across the specified fields.

- Complete the corresponding lines for transactions reported on Form 1099-B or Form 8949 based on the boxes checked.

- Calculate the total net short-term capital gain or loss and enter the result in the designated field.

- Move to Part II for long-term capital gains and losses, and repeat the steps for entering proceeds, cost, adjustments, and calculating the long-term gain or loss.

- Add the totals in Part III, summarizing both short-term and long-term net gains or losses.

- If applicable, complete Part IV for capital loss limitation and Part V for tax computation using maximum capital gains rates, as required.

- Once all sections are completed, save your changes, and opt to download, print, or share the finished form as needed.

Start filing your IRS forms online today for a seamless tax preparation experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.