Loading

Get Irs Instruction 2441_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Instruction 2441_DSA online

Filling out the IRS Instruction 2441_DSA online can seem daunting, but with a systematic approach, you can complete it efficiently. This guide offers comprehensive, step-by-step instructions to help you navigate each section of the form seamlessly.

Follow the steps to complete the IRS Instruction 2441_DSA online.

- Press the ‘Get Form’ button to access the IRS Instruction 2441_DSA and open it in the editor.

- Review the purpose of the form. This form is essential for users who paid someone for the care of a child or qualifying person to enable them to work or look for work.

- Fill out the personal details section, including your name and Social Security number. Ensure this matches your identification documents.

- Check the appropriate boxes regarding your filing status, as this impacts your eligibility for tax credits.

- Indicate the care provider details in the designated columns. Ensure to provide accurate names, addresses, and identification numbers.

- Complete the sections regarding qualifying persons by entering their names and Social Security numbers. Ensure that the information matches their official identification.

- Calculate your eligible expenses in relation to employment-related care. Clearly document these amounts as required in the respective sections.

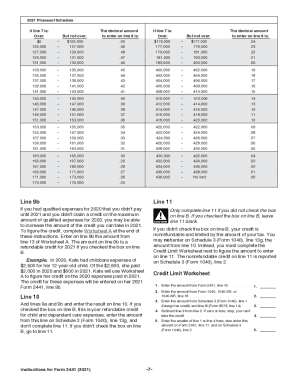

- Review the new provisions for 2021, including any changes to credit percentages and maximum qualifying expenses as per the American Rescue Plan Act.

- Evaluate the fields for the refundable and nonrefundable credits based on your filing status. Be precise in entering these amounts in the correct lines.

- Once you have completed the form, review all entries thoroughly for accuracy, then save your changes. You can download or print the completed form for your records.

Start filling out your IRS Instruction 2441_DSA online today to ensure you utilize your eligible credits efficiently.

A qualifying person is any of the following. A qualifying child under age 13 whom you can claim as a dependent. If the child turned 13 during the year, the child is a qualifying person for the part of the year he or she was under age 13.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.