Get Irs 4506-a_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4506-A_DSA online

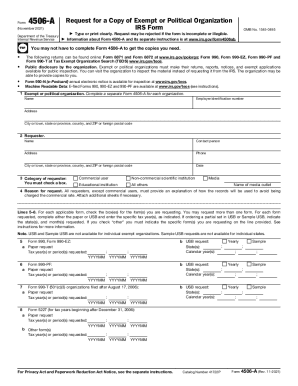

The IRS 4506-A_DSA is a request form that allows users to obtain copies of exempt and political organization documents. This guide provides clear, detailed instructions on completing the form online to ensure that all necessary information is accurately provided.

Follow the steps to complete the IRS 4506-A_DSA online.

- Click 'Get Form' button to access the form and open it in your editor of choice.

- In the first section, enter the name of the exempt or political organization you are requesting documents for. Provide the employer identification number (EIN), the complete address, including city or town, state or province, country, and ZIP or foreign postal code.

- Fill in your information as the requester. Include your name, contact person (if applicable), complete address, phone number, city or town, state or province, country, and ZIP or foreign postal code. Also, include the date of the request.

- Select the category of requester by checking the appropriate box, whether you are a commercial user, non-commercial scientific institution, educational institution, all others, or media. If you are from a media outlet, provide the name of the media organization.

- Provide a reason for your request if you are not a commercial user. Include an explanation of how you will utilize the records, as this helps to avoid being charged the commercial rate. Feel free to attach additional sheets if necessary.

- For each applicable document you are requesting, check the corresponding box. You can request multiple documents if needed. Enter the specific tax year(s) for each form requested, as indicated.

- If ordering copies in USB format, specify the state(s) and calendar year(s). For any forms not listed, select ‘other’ and indicate the specific forms you need on the provided line.

- Review all entries for accuracy. Ensure that all required fields are completed. Once you have finished filling out the form, you can choose to save changes, download, print, or share the completed form.

Start filling out the IRS 4506-A_DSA online today for your document needs.

0:37 2:12 Learn How to Fill the Form 4506-T Request for Transcript of Tax Return YouTube Start of suggested clip End of suggested clip Six you must select the type of tax return which you are requesting. Such as a 1040. Return 1065.MoreSix you must select the type of tax return which you are requesting. Such as a 1040. Return 1065. Return or 1120. Return you must next select the type of transcript. You want to receive.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.