Loading

Get Irs 4972_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4972_DSA online

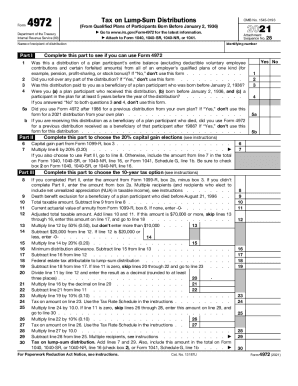

Filling out the IRS 4972_DSA form can be a straightforward process when guided step by step. This form is used to compute the tax on qualified lump-sum distributions from retirement plans for those born before January 2, 1936.

Follow the steps to complete the IRS 4972_DSA form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- At the top of the form, enter the name and identifying number of the recipient of the distribution. If there are multiple distributions, ensure you aggregate them or file separate forms as applicable.

- In Part I, answer the eligibility questions thoroughly. These include whether the distribution is from a qualified plan, if it was rolled over, and if you are a beneficiary to ensure you qualify to use this form.

- Proceed to Part II if eligible, where you can elect to apply the 20% capital gain election. Enter the applicable amount from Form 1099-R in the corresponding fields.

- Fill out Part III if you wish to utilize the 10-year tax option for distributions. Again, complete the lines with information from your Form 1099-R, ensuring accuracy.

- After completion, review your entries carefully for accuracy. Save your progress to ensure no data is lost.

- Once finalized, download the form to keep a local copy, or print it if you prefer physical documentation. You can also share the form as needed before submitting it to the IRS.

Ensure accurate filing of your documents online by completing the IRS 4972_DSA today.

If you were older than 59-1/2 before you received a lump sum from a qualified employee retirement plan, you may have some other options that can reduce your tax bill. To use any of these special treatments, you must complete IRS Form 4972, Tax on Lump-Sum Distributions, and attach it to your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.