Loading

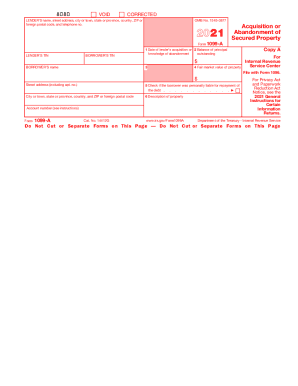

Get Irs 1099-a 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-A online

Filling out the IRS 1099-A form online is essential for reporting the acquisition or abandonment of secured property. This guide provides a clear, step-by-step approach to help users complete the form accurately and effectively.

Follow the steps to complete the IRS 1099-A form online.

- Click ‘Get Form’ button to access the IRS 1099-A form online. This action allows you to obtain the form in an editable format.

- Enter the lender's information in the designated fields. This includes the lender's full name, street address, city or town, state or province, country, ZIP code, and telephone number.

- Provide the lender’s taxpayer identification number (TIN) in the specified box.

- Input the borrower's taxpayer identification number (TIN) as well, ensuring it is accurate.

- Complete the following fields: Box 1 for the date of the lender’s acquisition or knowledge of abandonment, and Box 2 for the balance of principal outstanding at that time.

- Fill in Box 4 with the fair market value of the property involved in the transaction.

- Indicate whether the borrower was personally liable for the debt in Box 5.

- Provide a brief description of the property in Box 6 to clarify the asset involved.

- Review all entries for accuracy and completeness. Make corrections as necessary.

- Once satisfied with the information entered, save changes, then download, print, or share the completed form as needed.

Start completing your IRS 1099-A form online to ensure accurate reporting.

On Form 1099-A, the lender reports the amount of the debt owed (principal only) and the fair market value (FMV) of the secured property as of the date of the acquisition or abandonment of the property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.