Loading

Get Irs 8853 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8853 online

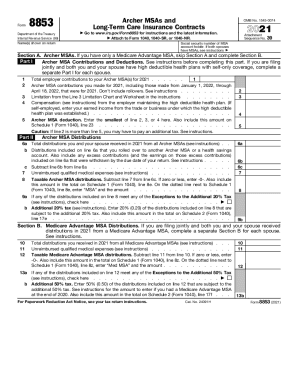

Filling out the IRS Form 8853 is an essential step for people who have Archer Medical Savings Accounts (MSAs) or Medicare Advantage MSAs. This guide provides clear instructions to help you complete this form accurately and efficiently online.

Follow the steps to successfully complete your IRS 8853 form.

- Click the ‘Get Form’ button to obtain the IRS 8853 form and open it in your preferred editor.

- Begin by entering the name(s) shown on the return and the social security number of the MSA account holder, as this information is crucial for identification.

- In Section A, if you have solely a Medicare Advantage MSA, skip this section and proceed to Section B. Otherwise, provide details in Part I about contributions and deductions related to your Archer MSA.

- For line 1, input the total employer contributions made to your Archer MSA(s) during the specified year.

- On line 2, record your own contributions made to the Archer MSA for the year, including contributions made after the year-end date but within the due date for filing your return.

- For line 3, refer to the limitation chart in the instructions to fill in the limitation amount.

- Line 4 requires you to enter your compensation from the employer maintaining the high deductible health plan.

- On line 5, calculate the Archer MSA deduction, which should be the smallest amount from lines 2, 3, or 4.

- Move on to Part II and report total distributions received from all Archer MSAs in line 6a.

- Complete line 6b to indicate any distributions included in line 6a that were rolled over or contributed to a health savings account.

- Line 6c is where you subtract line 6b from line 6a to find your net distributions.

- On line 7, report your unreimbursed qualified medical expenses.

- Calculate taxable distributions on line 8 by subtracting line 7 from line 6c, and ensure to include the amount on your Schedule 1 (Form 1040).

- In Section B, if applicable, complete similar fields for Medicare Advantage MSA distributions.

- If filing jointly, separate sections should be completed for each spouse as necessary.

- Finally, review your form, save changes, and choose your option to download, print, or share it accordingly.

Complete your IRS Form 8853 online today to ensure accurate reporting and compliance.

Related links form

you must file Form 8853 with Form 1040, 1040-SR, or 1040-NR even if you have no taxable income or any other reason for filing Form 1040, 1040-SR, or 1040-NR. Name and social security number (SSN). Enter your name(s) and SSN as shown on your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.