Loading

Get Irs W-3pr_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-3PR_DSA online

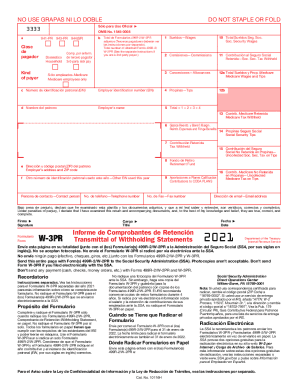

Filling out the IRS W-3PR_DSA online is an essential step for employers submitting their withholding statements to the Social Security Administration. This guide will walk you through each section of the form, ensuring that you confidently complete it correctly.

Follow the steps to complete the IRS W-3PR_DSA form online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin filling in the form starting with the 'Kind of payer' section, ensuring to select the appropriate designation that reflects your business type.

- Provide the employer identification number (EIN) in the designated field, ensuring its accuracy, as this number is crucial for identification purposes.

- Input the employer’s name and address in the respective sections. Be sure to include the ZIP code for completeness.

- Complete the wage information fields including total wages, commissions, tips, and any other earnings. Double-check that these amounts are consistent with the attached Forms 499R-2/W-2PR.

- Fill in the withheld taxes fields for Social Security and Medicare, ensuring you adhere to the guidelines on the appropriate contribution amounts.

- Review all entries for accuracy, taking care to confirm that the tax year is correct and aligns with your records.

- Once all fields are completed accurately, save your changes. You can then download and print the form for your records.

- Submit the completed form along with Forms 499R-2/W-2PR to the Social Security Administration by the specified deadline.

Start completing your IRS W-3PR_DSA form online today to ensure timely submission.

Is there mandatory tax withholding from RMD? Because an RMD cannot be rolled over, the mandatory 20% tax withholding does not apply. Rather, the default withholding rate is 10% of the RMD amount; however, a participant can elect to have more or less withheld, and may even choose to waive withholding altogether.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.