Loading

Get Dor.ri.govrhode Island - Welcomeri Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dor.ri.govRhode Island - WelcomeRI Department Of Revenue online

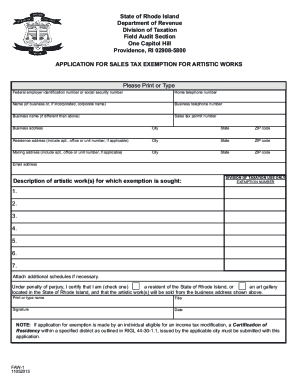

This guide is designed to support users in completing the application for sales tax exemption for artistic works issued by the Rhode Island Department of Revenue. By following the steps outlined below, you will be able to accurately fill out the form online and submit your application with confidence.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to retrieve the application for sales tax exemption and open it in an online editor.

- Begin by entering your federal employer identification number or social security number in the designated field.

- Input your home telephone number, ensuring to provide a valid contact number.

- Fill in the name of your business or, if applicable, the corporate name.

- If your business name differs from the above, enter that in the business name field.

- Provide your sales tax permit number in the appropriate section.

- Complete your business address, including street, city, state, and ZIP code.

- Enter your residence address, making sure to include any apartment, office, or unit number if necessary.

- Provide the mailing address, including apt., office, or unit number if applicable, along with the city, state, and ZIP code.

- Input your email address for further communication regarding your application.

- Describe the artistic work(s) for which you are seeking a sales tax exemption. Be as detailed as possible to support your application.

- If more space is needed, attach additional schedules as necessary to provide complete information about the artistic works.

- Under penalty of perjury, certify your residency status by selecting the appropriate checkbox indicating whether you are a resident of Rhode Island or an art gallery located in Rhode Island.

- Print or type your name, title, and provide your signature and the date at the bottom of the form.

- Once you have completed all sections of the form, save changes, and consider downloading, printing, or sharing the form for your records.

Complete your application for sales tax exemption online today to ensure timely processing.

Please be advised payments made by Credit/Debit cards will be charged a convenience fee of 2.85% of the amount being paid. Pay by credit card for same-day DMV release. If you are paying a past-due tax, contact us to remove the DMV block. E-check payments are a flat fee of $1.50.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.