Loading

Get Irs 4797_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4797_DSA online

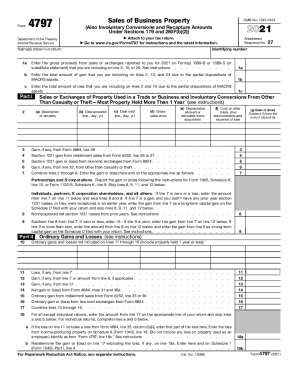

The IRS 4797_DSA form is essential for reporting the sale or exchange of business property, including involuntary conversions and recapture amounts. This guide provides clear, step-by-step instructions to assist users in completing the form online accurately.

Follow the steps to complete your IRS 4797_DSA form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, begin by entering the gross proceeds from sales or exchanges reported to you on Form(s) 1099-B or 1099-S. This value is entered in line 1a.

- Continue filling out lines 1b and 1c with the total gains and losses resulting from partial dispositions of MACRS assets.

- In lines 2 through 6, list the properties sold or exchanged. For each property, provide the description, acquisition date, sale date, gross sales price, depreciation allowed or allowable, and the cost or other basis.

- Combine the figures from lines 2 through 6 and enter the total gain or loss on line 7.

- Move to Part II. Enter any ordinary gains and losses in lines 10 through 17, ensuring to fill in the appropriate values based on the assets sold.

- In Part III, provide details for gains from dispositions under various sections. Fill in the details for each property listed about the acquisition and sales dates and the relevant financial information.

- Conclude by reviewing your inputs for accuracy. When satisfied, save your completed form, and download, print, or share it as needed.

Start completing your IRS 4797_DSA form online to ensure accurate reporting of your business transactions.

What Is the Difference Between Schedule D and Form 4797? Schedule D is used to report gains from personal investments, while Form 4797 is used to report gains from real estate dealings—those that are done primarily in relation to business rather than personal transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.