Loading

Get Irs 4952_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4952_DSA online

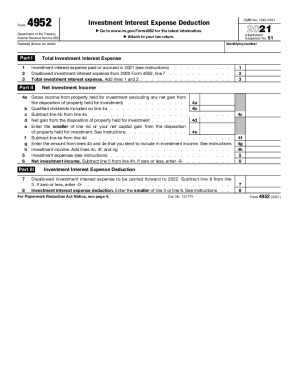

This guide provides comprehensive, step-by-step instructions for filling out the IRS Form 4952_DSA online, which is used to calculate the investment interest expense deduction. Designed to be accessible for all users, this guide will support you through the process.

Follow the steps to complete the IRS 4952_DSA online.

- Click ‘Get Form’ button to access the IRS Form 4952_DSA online and open it for editing.

- Begin by entering your identifying information as shown on your tax return, including your name and any necessary identification numbers.

- In Part I, provide the total investment interest expense you paid or accrued during the tax year. This includes any investment interest reported to you on Schedule K-1 from partnerships or S corporations.

- Complete Part II by calculating your net investment income. Start with the gross income from property held for investment, and ensure to exclude net gains from property dispositions.

- During this section, report qualified dividends and net capital gains as instructed, being mindful of any deductions that may apply.

- In Part III, compute the investment interest expense deduction by subtracting your investment expenses from your net investment income and determine how much can be carried forward.

- Once all fields are accurately filled out, review your entries for any errors or omissions.

- Finally, save your changes, download the completed form, print it for your records, or share it as needed to attach to your tax return.

Start filling out your IRS 4952_DSA form online today to ensure you claim your investment interest expense deduction accurately.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Investment (margin) interest deduction is claimed on Form 4952 Investment Interest Expense Deduction and the allowable deduction will flow to Schedule A (Form 1040) Itemized Deductions, Line 9 to be claimed as an itemized deduction, up to the amount of your investment income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.