Loading

Get Irs 4136_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4136_DSA online

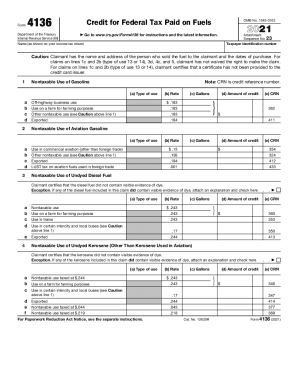

The IRS 4136_DSA form is used to claim a credit for federal tax paid on fuels. This guide provides clear and comprehensive steps on how to fill out this form online, ensuring you can navigate through each section with ease.

Follow the steps to successfully complete the IRS 4136_DSA form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer identification number, which is required to identify your tax records.

- Provide your name as shown on your income tax return to ensure the form is matched with your existing records.

- Fill out the sections describing the nontaxable use of gasoline, aviation gasoline, undyed diesel fuel, and kerosene, ensuring to specify the type of use and provide details on the rate, gallons, and amount of credit.

- For each relevant section, accurately enter the credit reference number (CRN) where applicable, as this number is crucial for tracking your claim.

- Review your entries to ensure all information is accurate and complete, avoiding potential delays in processing.

- At the final step, save your changes, and choose whether to download, print, or share the form as needed.

Complete your IRS 4136_DSA form online today to ensure accurate and timely claims for fuel tax credits.

NOTE: This incentive was originally set to expire on December 31, 2021, but has been extended through December 31, 2024, by Public Law 117-169. A tax incentive is available for alternative fuel that is sold for use or used as a fuel to operate a motor vehicle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.