Loading

Get Mt Form 2 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT Form 2 online

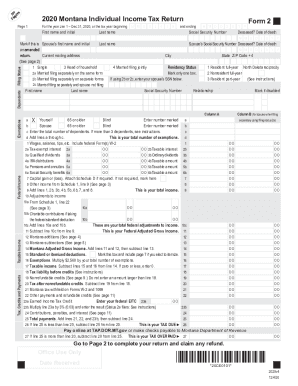

Completing the Montana Form 2 online can streamline your tax filing process and ensure accuracy. This guide offers clear and detailed instructions to help you navigate through each section of the form with confidence.

Follow the steps to fill out the MT Form 2 successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information such as your first name, last name, and social security number in the designated fields. Ensure your details are accurate and match your identification documents.

- Select your filing status from the provided options, marking the appropriate box. This includes options such as 'single', 'married filing jointly', or 'head of household'.

- Indicate your residency status by marking only one box that applies to your situation. This section is critical as it affects your tax calculations.

- Input your total income by listing various income sources such as wages, interest, and dividends. Each source requires careful entry in the specified lines; if needed, attach any necessary schedules.

- Adjust your income by entering any deductions and adjustments from the related schedules. This can include charitable contributions and retirement account contributions, among others.

- Calculate your taxable income by subtracting total deductions and exemptions from your adjusted gross income. This total will inform your tax liability.

- Once all fields are completed, review the form for accuracy. Ensure all information is correct and complete to avoid processing delays.

- Finally, save your changes, and choose to download, print, or share the form as required. Be sure to follow up as necessary to complete your filing.

Begin completing your MT Form 2 online to ensure a smooth tax filing process today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Who is eligible to file ITR-2 for AY 2021-22? Do not have income from profit and gains of business or profession and also do not have income from profits and gains of business or profession in the nature of: interest. salary.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.