Loading

Get Az Dor Form 321 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ DoR Form 321 online

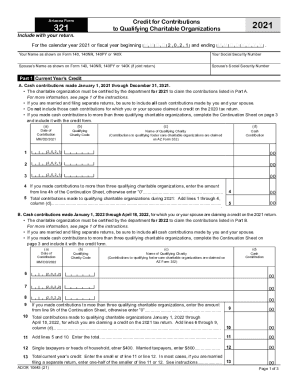

The AZ DoR Form 321 is an important document for asserting tax credits related to contributions made to qualifying charitable organizations. This guide will provide you with a clear step-by-step process for filling out this form online.

Follow the steps to successfully complete the AZ DoR Form 321.

- Click 'Get Form' button to obtain the AZ DoR Form 321 and open it in your preferred editor.

- Begin by entering your name and social security number as shown on your tax return forms (Form 140, 140NR, 140PY, or 140X) at the top of the form.

- If filing a joint return, include your spouse's name and social security number in the designated fields.

- Navigate to Part 1: Current Year’s Credit, where you will list cash contributions made in 2021. Be sure to record contributions made to qualifying organizations only.

- For each contribution, enter the date, qualifying charity code, name of the charity, and the amount of the cash contribution in the corresponding fields.

- If you contributed to more than three organizations, ensure you complete the Continuation Sheet on page 3 and include that with your form.

- Calculate the total contributions made during 2021 by summing the amounts you entered, and record that total on the appropriate line.

- Proceed to Part 2 if you have available credit carryover from previous years, following the same method to record information in each column.

- In Part 3, enter the current year's credit from Part 1, any carryover credit from Part 2, and calculate the total available credit.

- Once all sections are filled out accurately, review your entries, then save the changes to the form. You can also choose to download, print, or share the completed form as needed.

Complete the AZ DoR Form 321 online today to ensure you receive the tax credits you deserve.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Public Schools Receiving Contributions or Fees A public school can accept contributions for eligible activities, programs or purposes. A credit is allowed against the taxes imposed by the state for the amount of any fees paid or cash contributions made by a taxpayer pursuant to section A.R.S.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.