Loading

Get Az Dor 82514_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ DOR 82514_DSA online

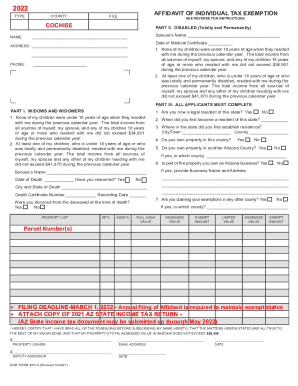

Filling out the AZ DOR 82514_DSA form online is essential for individuals seeking property tax exemptions in Arizona. This guide provides comprehensive instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the AZ DOR 82514_DSA online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with your name and address in the designated fields. Ensure your contact information is clear and accurate, as this will be crucial for any correspondence regarding your application.

- In Part II, if applicable, provide your spouse's name and date of the medical certificate. If you have children, indicate if none were under 18 years old and that your total income did not exceed $34,901 in the previous calendar year or state if at least one child was under 18 or disabled, with the income limit being $41,870.

- Complete Part III for all applicants. Here, repeat the income statements relevant to the previous calendar year and provide your spouse's name and date of death if applicable. Indicate whether you have remarried and provide the city and state of the deceased's death.

- Fill in the property list section, including information on property ownership, percentage interest, assessed value, and any exemptions being claimed.

- After reviewing all the information for accuracy, sign the affidavit. Ensure the signature is original or notarized if not signed in the presence of an assessor’s representative.

- Finally, save changes, download the completed form for your records, or print it. Ensure submission before the relevant deadline to maintain your property tax exemption status.

Complete your AZ DOR 82514_DSA online today for a smoother property tax exemption application process.

"The Arizona Department of Revenue does not call to demand immediate payment or call about taxes owed without having initial communication with them through the mail." Arizonans with tax-related ID theft questions should contact the ADOR's identity theft call center or the Internal Revenue Service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.