Loading

Get Fdic 6822/02 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FDIC 6822/02 online

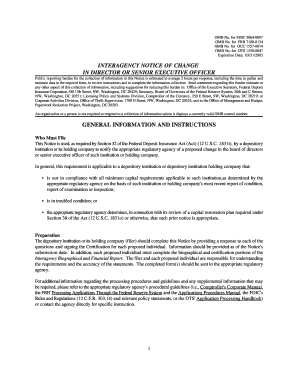

Filling out the FDIC 6822/02 form online can be a straightforward process with the right guidance. This document serves as a vital notification for any proposed changes in the board of directors or senior executive officers of a depository institution or its holding company.

Follow the steps to successfully complete the FDIC 6822/02 form.

- Press the ‘Get Form’ button to access the form and open it in your chosen editing tool.

- Provide the full name of the individual who will serve as a director or senior executive officer, and specify their title. Indicate whether this is to replace an existing individual or to fill a new position.

- Select the type of filing you are submitting, indicating if it is a prior notice, after-the-fact notice, or if a waiver was previously granted.

- Fill out the name of the depository institution or holding company, including the street address, county, city, state, and zip code.

- Summarize the steps taken by the institution or holding company to ensure the suitability of the individual, detailing their qualifications for the proposed position.

- For senior executive officer proposals, describe the duties and responsibilities associated with the position, or attach a detailed position description.

- Discuss the proposed terms of employment for the individual, including any applicable employment contracts or compensation arrangements and attach pertinent documents.

- Review all information for accuracy before signing the certification, confirming that the details are correct and complete.

- Submit the completed form to the appropriate regulatory agency as required.

Start completing your form online today to ensure timely processing.

FDIC rating 2 typically signifies a bank's financial health according to the FDIC's assessment. This rating suggests that the institution is considered satisfactory but may have some weaknesses that require monitoring. When looking into banks with a FDIC 6822/02 designation, understanding these ratings can help you make informed decisions about where to secure your funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.