Loading

Get Mn Dor Schedule M1cr 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1CR online

Filling out the MN DoR Schedule M1CR online can be a streamlined process when you know what to expect. This guide will help you understand each section of the form and ensure you complete it accurately.

Follow the steps to effectively fill out the MN DoR Schedule M1CR.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

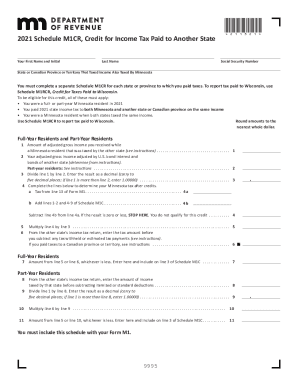

- Start by entering your first name, middle initial, and last name in the designated fields at the top of the form. Ensure the spelling matches your identification documents.

- Provide your social security number in the appropriate field. This number is crucial for processing your credit.

- Identify the state or Canadian province that taxed your income, which is also taxed by Minnesota. Remember, you need to complete a separate Schedule M1CR for each state or province.

- Enter the amount of adjusted gross income you received while a Minnesota resident that was also taxed by another state on line 1.

- On line 2, input your adjusted gross income adjusted by U.S. bond interest and bonds from another state. Refer to the instructions if needed.

- Calculate the decimal value by dividing line 1 by line 2 and enter that value on line 3, ensuring it carries five decimal places.

- Complete the tax determination on lines 4a and 4b. Enter the tax from Form M1 on line 4a and calculations from Schedule M1C on line 4b.

- Subtract line 4b from line 4a to determine your eligibility for the credit. If the result is zero or less, you do not qualify for this credit.

- Multiply line 4 by the decimal on line 3 and write the result on line 5.

- Input the tax amount from the other state’s tax return on line 6, ensuring this is before any deductions.

- For full-year residents, enter the lesser amount from line 5 or line 6 on line 7.

- If you are a part-year resident, follow the specified instructions to enter your data on lines 8, 9, and 10. Then enter the lesser amount from line 5 or 10 on line 11.

- Once you have completed all sections accurately, review your entries. You can then save the changes, download, print, or share the completed form as needed.

Complete your MN DoR Schedule M1CR online to ensure you meet your tax credit obligations.

Related links form

Generally speaking, the IRS deposits money on a Friday. However, your bank may take a day or two extra to post it to your account. If you chose to have a check mailed to you, it will take approximately 10 days longer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.