Loading

Get Mn Dor Schedule M1ls 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1LS online

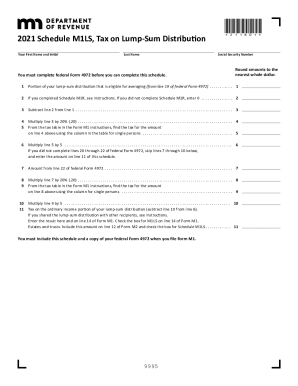

Filling out the MN DoR Schedule M1LS is a necessary step for individuals who received a lump-sum distribution from certain retirement plans. This guide will walk you through the process of completing the form online efficiently and accurately.

Follow the steps to complete your Schedule M1LS online.

- Press the ‘Get Form’ button to obtain the Schedule M1LS and open it in the editor.

- Enter your first name and initial in the designated field, followed by your last name. Ensure that all names are spelled correctly to avoid processing delays.

- Input your Social Security Number in the appropriate section. This will be necessary for identification purposes.

- Complete federal Form 4972 before proceeding, as some calculations are dependent on information from this form.

- For line 1, enter the portion of your lump-sum distribution that qualifies for averaging based on line 19 of federal Form 4972.

- For line 2, if you completed Schedule M1R, enter the applicable amount; otherwise, enter 0.

- Move to line 3. Subtract the amount on line 2 from that on line 1, and input the result.

- For line 4, multiply the result from line 3 by 20% (0.20) and enter the figure.

- Consult the tax table included in the Form M1 instructions for line 5. Find and input the tax corresponding to the amount from line 4, using the column designated for single persons.

- For line 6, multiply the amount from line 5 by 5 to get your next figure.

- Skip lines 7 through 10 if you did not complete lines 20 through 22 of federal Form 4972, and enter the result from line 11 of this schedule directly.

- If applicable, refer to the line instructions to complete lines 7, 8, 9, and 10 as needed.

- For line 11, subtract the amount on line 10 from line 6 and enter the result. If the distribution was shared, follow the specific instructions to determine the amount for this line.

- After completing the form, you can save changes, download a copy, print it, or share it as necessary.

Complete your Schedule M1LS online today to ensure your tax filing is accurate and timely.

Related links form

Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty. 3. Roth IRA contributions cannot be made by taxpayers with high incomes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.