Loading

Get Ok Ow-8-es_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

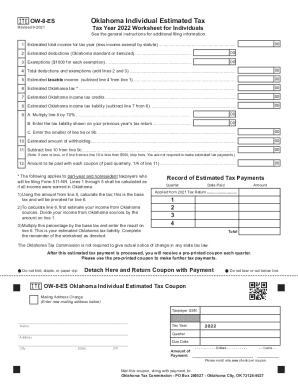

How to fill out the OK OW-8-ES_DSA online

Filling out the OK OW-8-ES_DSA online can seem daunting, but this guide will provide you with step-by-step instructions to simplify the process. By following these directions, you can complete the form accurately and efficiently.

Follow the steps to complete the OK OW-8-ES_DSA form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your estimated total income for the tax year in the designated field. Ensure that this amount reflects your earnings, minus any income that is exempt by statute.

- Fill in your estimated deductions, choosing either the Oklahoma standard deduction or itemized deductions, according to your financial situation.

- Input the number of exemptions you are claiming. Each exemption accounts for $1,000.

- Calculate and enter the total deductions and exemptions by adding the amounts from steps 3 and 4.

- Determine your estimated taxable income by subtracting the total deductions and exemptions from your estimated total income.

- Calculate your estimated Oklahoma tax. This is based on your estimated taxable income.

- Identify any estimated Oklahoma income tax credits that you qualify for and enter this amount.

- Calculate your estimated Oklahoma income tax liability by subtracting the amount of credits from your estimated tax.

- Follow the instructions to determine any prior year amounts to input, including how to calculate the smaller amount of line 9 results.

- Fill out the estimated amount of withholding if applicable.

- Subtract the withholding amount from your calculated tax liability to determine the final amount owed.

- If payments are to be made quarterly, divide the amount owed by four and enter this for the amount to be paid with each coupon.

- Review all entries for accuracy before saving your changes. Once verified, save, download, or print the completed form as needed for your records.

Complete and submit your OK OW-8-ES_DSA form online to ensure your estimated tax payments are processed efficiently.

Requesting a Penalty Waiver The Tax Commission will automatically apply a penalty when unpaid taxes are due. If at least 90% of the original tax liability has not been paid by the due date, a penalty of 5% will be assessed. You'll also be assessed interest on the balance due at a rate of 1.25% per month.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.