Loading

Get Ok Otc 994 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC 994 online

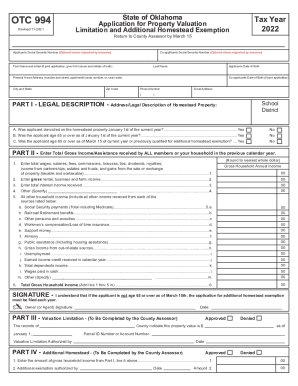

Filling out the OK OTC 994 form is crucial for those seeking property valuation limitations and additional homestead exemptions in Oklahoma. This guide provides a detailed, step-by-step approach to assist users in completing the form accurately and effectively online.

Follow the steps to successfully complete the OK OTC 994 form

- Click the ‘Get Form’ button to access the OK OTC 994 and open it in the editing interface.

- Begin by entering the applicant's social security number in the designated field, noting that this is optional unless requested by the assessor.

- Fill in the first name and initial along with the last name of the applicant. If this is a joint application, include the first names and initials of both applicants.

- Provide the applicant's date of birth in the appropriate section to verify eligibility.

- Input the present home address, including number and street, apartment or condo number, and rural route if applicable.

- Enter the city and state followed by the zip code to ensure accurate identification of the applicant's residence.

- Specify the tax year for which the exemption is being claimed, typically it will default to the current year.

- If applicable, include the co-applicant's date of birth and other optional information such as phone number and email address.

- Proceed to Part I where you will need to address the legal description of the homestead property and indicate residency status as of January 1.

- In Part II, report total gross income received by all household members from various income sources as outlined in the form.

- Make sure to round to the nearest whole dollar and accurately total the gross household income in the designated field.

- Sign the form to confirm the information provided is true and accurate, including the date of signature.

- Once all fields are completed, save your changes and choose to download, print, or share the form as necessary.

Complete your OK OTC 994 application online today to ensure your property exemptions are processed timely.

The property owner must be age 65 or over as of January 1st to qualify. Gross household income from the preceding year does not exceed the 2023 maximum income qualification of $85,300. This includes income from all sources (including all persons occupying the home), except gifts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.