Loading

Get Ok Form 599 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK Form 599 online

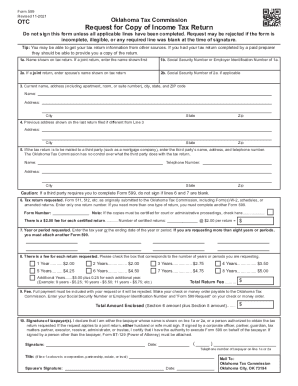

Filling out the OK Form 599 is essential for requesting a copy of your income tax return from the Oklahoma Tax Commission. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the OK Form 599 online:

- Click the ‘Get Form’ button to access the form and open it in the editor.

- In section 1a, enter the name shown on the tax return. If you filed a joint return, input the name of the primary filer.

- In section 1b, provide the Social Security Number or Employer Identification Number corresponding to the name entered in section 1a.

- For a joint return, fill out section 2a with your spouse’s name as it appears on the tax return. In section 2b, enter their Social Security Number, if applicable.

- Next, in section 3, input your current name and full address including apartment, room, or suite number, city, state, and ZIP code.

- If your previous address differs from the current one, complete section 4 with the address shown on your last filed return, including city, state, and ZIP code.

- If you would like the tax return mailed to a third party, provide their name, address, and telephone number in section 5.

- In section 6, specify the type of tax return requested by entering the form number (e.g., Form 511, 512). If you need more than one return, you must complete an additional Form 599.

- Indicate whether you require certified copies in section 6; note there is a fee of $2.00 per certified return.

- In section 7, enter the tax year or the ending date of the period you are requesting. Attach another Form 599 for more than eight years.

- In section 8, check the appropriate box corresponding to the number of years or periods requested; be mindful of the associated fees.

- Calculate the total return fee based on your selections in section 8 and input this amount in section 9.

- Ensure that full payment is included with your request, as an incomplete submission may be rejected.

- Sign and date the form in section 10. If applicable, include your spouse's signature.

- Mail the completed form to the Oklahoma Tax Commission at the address provided at the bottom of the form.

Begin filling out your OK Form 599 online to ensure a smooth request process.

A completed return must be filed within nine (9) months after the date of the decedent's death or interest will accrue. When To Pay: Estate tax is due and payable nine (9) months after the date of death. If not paid interest will begin accruing after due date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.