Loading

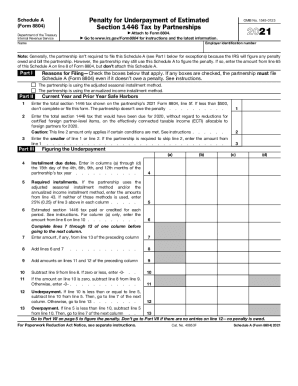

Get 2021 Schedule A (form 8804). Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2021 Schedule A (Form 8804). Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships online

This guide provides a comprehensive overview of how to accurately fill out the 2021 Schedule A (Form 8804) to assess the penalty for underpayment of estimated Section 1446 tax by partnerships. By following these simple steps, you can navigate the process with confidence and ensure compliance with IRS regulations.

Follow the steps to complete Schedule A (Form 8804) efficiently.

- Press the 'Get Form' button to obtain the Schedule A (Form 8804) document and open it for editing.

- Start by entering the partnership's name and employer identification number (EIN) at the top of the form.

- In Part I, check the appropriate boxes if the partnership is using the adjusted seasonal installment method or the annualized income installment method. If no boxes are checked, the partnership is typically not required to file this form.

- Move to Part II. For line 1, enter the total Section 1446 tax from the partnership’s 2021 Form 8804, line 5f. If this amount is less than $500, you do not need to complete or file this form.

- For line 2, enter the total Section 1446 tax due for 2020, as specified, noting the conditions that apply as guided by the instructions.

- On line 3, input the smaller amount from either line 1 or line 2, or enter the amount from line 1 if the partnership is required to skip line 2.

- Proceed to Part III to figure the underpayment. Enter the due dates of installments in columns (a) through (d) for the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year.

- In line 5, if necessary, enter required installments based on the applicable methods (either adjusted seasonal or annualized income). For typical cases, enter 25% of line 3 in each column.

- Fill in estimated Section 1446 tax paid or credited for each corresponding period in line 6, using the amount from line 10 for column (a).

- Complete lines 7 through 13 for each column before moving to the next. Follow the instructions to calculate underpayment (line 12) and overpayment (line 13) as applicable.

- If applicable, refer to Part IV for the adjusted seasonal installment method or Part V for the annualized income installment method, filling in as guided.

- To calculate the penalty, go to Part VII. Enter the required dates and compute the penalty based on the guidelines by adding the necessary calculations for underpayment across the columns.

- Finally, save your changes. You can download the filled form, print it, or share it as needed.

Ready to complete your forms online? Start now for a hassle-free experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A PTP that has effectively connected income, gain, or loss must withhold tax on distributions of that income made to its foreign partners. The rate is 37% (0.37) for non-corporate foreign partners, and 21% (0.21) for corporate partners.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.