Loading

Get Fillable Online Tax Virginia Form Fwv Application For Farm ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Online Tax Virginia Form FWV Application For Farm Wineries and Vineyards Tax Credit online

Filling out the Fillable Online Tax Virginia Form FWV Application For Farm Wineries and Vineyards Tax Credit can seem challenging. This guide provides a structured approach to help you navigate each section of the form with ease.

Follow the steps to complete the application accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

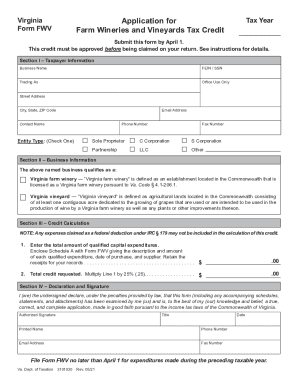

- Begin with Section I – Taxpayer Information. Fill in the business name, FEIN/SSN, trading as, street address, city, state, ZIP code, email address, contact name, phone number, and fax number. Be sure to check the appropriate entity type by marking one of the options provided.

- Proceed to Section II – Business Information. Indicate whether your business qualifies as a Virginia farm winery or a Virginia vineyard by checking the corresponding box.

- For Section III – Credit Calculation, enter the total amount of qualified capital expenditures. Remember to attach Schedule A that details each qualified expenditure along with the purchase date and supplier. Keep your receipts for your records.

- Calculate the total credit requested by multiplying the total from Step 4 by 25%. Clearly provide this amount in the designated area.

- In Section IV – Declaration and Signature, sign and date the form. Include your printed name, phone number, email address, and fax number.

- Review your form carefully to ensure all information is accurate and complete. After finalizing, proceed to save changes, download, print, or share the form as needed.

Submit your completed form online to ensure timely processing and claim your credit.

Here are 15 tax breaks and tips for farmers. Understand What You Must Report as Income. ... Spend Wisely. ... Take All Eligible Deductions. ... Use Depreciation Properly. ... Pay Your Kids to Work. ... Track Your Deductible Expenses. ... Report Resale of Livestock. ... Use Income Averaging.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.