Loading

Get Irs 5472_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5472_DSA online

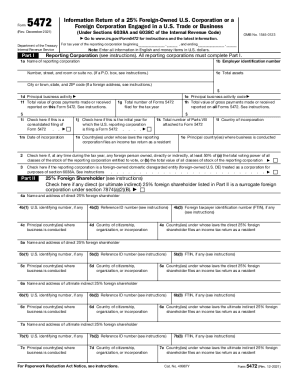

The IRS 5472_DSA is an information return required for certain foreign-owned U.S. corporations. This guide aims to provide clear, step-by-step instructions on how to complete this form effectively and efficiently online.

Follow the steps to accurately complete the IRS 5472_DSA.

- Click ‘Get Form’ button to obtain the IRS 5472_DSA and open it in the online editor.

- Begin filling out Part I by entering the name of the reporting corporation in the designated field, followed by the employer identification number and total assets. Please ensure all information is entered accurately and in English.

- Continue to fill out the remaining fields in Part I, including the principal business activity, total value of gross payments made or received, and checkboxes that apply to your situation, such as whether this is a consolidated filing.

- Move on to Part II, where you will identify any 25% foreign shareholders. Provide the names, addresses, and relevant identifiers, ensuring you complete all necessary fields to comply with IRS requirements.

- Proceed to Part III by defining the related party's information. Indicate whether they are a U.S. or foreign person and fill in their name, address, and identifying information.

- In Part IV, report any monetary transactions between the reporting corporation and foreign related parties. Complete each category honestly and thoroughly for transparency.

- Continue through Parts V through VIII, detailing additional information and cost-sharing arrangements. Ensure that all transactions are reported accurately, as required.

- Finally, review all entries for accuracy, and once complete, you can save changes, download, print, or share the form as necessary.

Start filling out the IRS 5472_DSA online today to ensure compliance and accurate reporting.

Related links form

Reasonable cause generally means that a taxpayer exercised ordinary business care and prudence but nevertheless failed to comply with its tax obligations. The regulations applicable to Form 5472 penalties contain some guidance on the reasonable cause standard.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.