Loading

Get Irs W-8imy_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-8IMY_DSA online

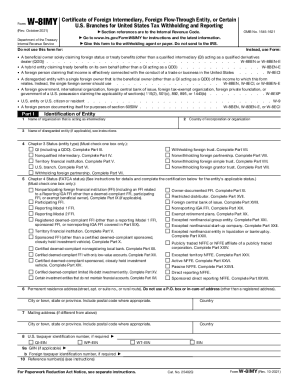

The IRS W-8IMY_DSA form is crucial for foreign intermediaries and flow-through entities to certify their status for United States tax withholding and reporting. This guide provides step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to complete the W-8IMY_DSA form online.

- Click the ‘Get Form’ button to obtain the IRS W-8IMY_DSA form and open it in your preferred document editor.

- Fill out Part I, which requires the identification of the entity acting as the intermediary, including the name, country of incorporation, and type of entity according to Chapter 3 and Chapter 4 statuses. Make sure to check the appropriate box identifying the entity type.

- Provide the permanent residence address of the entity in the specified fields. Ensure you do not use a P.O. box or in-care-of address.

- If applicable, complete parts related to the branch or disregarded entity receiving payments by including their status and address details.

- In Part III, certify the Chapter 3 status and provide relevant withholding statements as required, ensuring all necessary boxes are checked.

- Continue filling out any applicable Parts IV through XXIX according to the nature of the entity, checking all relevant certifications and providing any additional information required.

- Once all sections are thoroughly completed, review the form for accuracy. Then, proceed to save, download, print, or share the finalized form as needed.

Start filling out your IRS W-8IMY_DSA form online today to ensure compliance with tax regulations.

A W-8 form allows non-US individuals and businesses to confirm they are not US taxpayers. A W-8 form from the US Internal Revenue Service (IRS) allows non-US individuals and businesses to confirm they are not a US taxpayer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.