Loading

Get Www.irs.govpubirs-pdf2021 Schedule E (form 990) - Internal Revenue Service

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Www.irs.govpubirs-pdf2021 Schedule E (Form 990) - Internal Revenue Service online

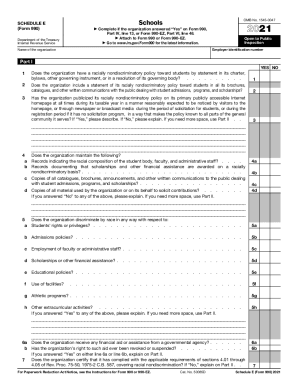

Filling out the Schedule E (Form 990) is crucial for organizations that provide information on private schools as part of their tax filings. This guide offers clear, step-by-step instructions to help users navigate the form online efficiently and accurately.

Follow the steps to complete the Schedule E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the employer identification number and the name of the organization at the top of the form. This information is essential for identification purposes.

- Proceed to Part I. Answer the questions regarding the organization’s nondiscriminatory policy by selecting 'Yes' or 'No'. Provide clear explanations in Part II when necessary.

- For question 1, confirm if the organization has a racially nondiscriminatory policy as required. If answered 'Yes', ensure to maintain relevant documentation.

- In question 2, indicate whether the nondiscriminatory policy is included in all promotional materials. This promotes transparency towards prospective students.

- Continue with questions 3 to 5, ensuring to provide comprehensive descriptions wherever 'Yes' or 'No' responses are given. Use Part II for additional space as needed.

- At question 6, specify if the organization receives financial aid and provide explanations for any past revocations or suspensions, if applicable.

- For question 7, confirm compliance with the racial nondiscrimination requirements as outlined and ensure an authorized individual certifies this information.

- Review all entries for accuracy and completeness before finalizing. Users can save changes, download, print, or share the completed form as required.

Complete your Schedule E (Form 990) online today to ensure compliance and ease in your reporting process.

Who must file Form 990-N (e-Postcard)? Most small tax-exempt organizations whose gross receipts are normally $50,000 or less must file Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations not Required To File Form 990 or 990-EZ.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.