Loading

Get Co Dr 1002 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DR 1002 online

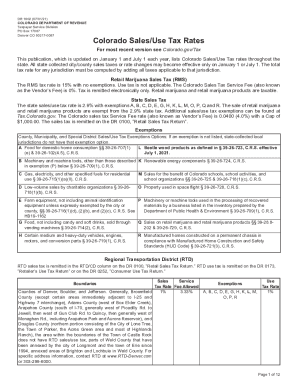

The CO DR 1002 form is essential for reporting Colorado sales and use tax rates. This guide provides a step-by-step approach for completing this form online, ensuring clear understanding for users of all backgrounds.

Follow the steps to successfully complete the CO DR 1002 form.

- Click the ‘Get Form’ button to access the CO DR 1002, opening it in your preferred online editor.

- Begin with section one, which outlines the taxpayer's details. Accurately fill in your name, address, and any other requested information to identify yourself as the taxpayer.

- Proceed to section two, where you will list the total sales and use tax collected. Be sure to include all applicable sales from your business operations.

- In the subsequent section, detail any exemptions that apply to your sales. Make sure to reference the provided exemption codes correctly.

- Continue to the section for calculations, where you will compute the total taxes owed based on your reported sales and exemptions.

- Finally, review all filled sections for accuracy. Once completed, you can save your changes, download the form, print a copy, or share it as needed.

Complete the CO DR 1002 form online today for successful tax reporting.

Related links form

States with the lowest sales tax New York: 4% sales tax rate. Wyoming: 4% sales tax rate. Colorado: 2.9% sales tax rate. Alaska: no sales tax. Delaware: no sales tax. Montana: no sales taxes. New Hampshire: no sales tax. Oregon: no sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.