Loading

Get Hi Bfs-rp-p-51 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI BFS-RP-P-51 online

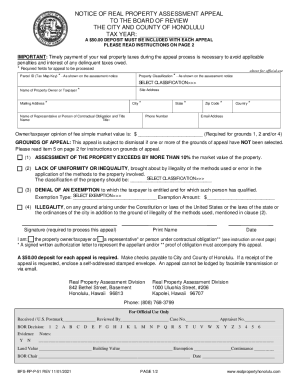

The HI BFS-RP-P-51 form is essential for individuals seeking to appeal a real property assessment in Honolulu. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully fill out the HI BFS-RP-P-51.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year in the designated field. This information is crucial for the processing of your appeal.

- Include a $50.00 deposit with each appeal. Ensure that the payment is made by check payable to the City and County of Honolulu.

- Fill in the Parcel ID (Tax Map Key) as indicated on your assessment notice. This is a required field that must be completed for your appeal to be processed.

- Choose the Property Classification from the options provided on your assessment notice and enter it in the field.

- Input your name as the property owner or taxpayer, along with your mailing and site address, including city, state, zip code, and country.

- Provide your email address and phone number to facilitate communication regarding your appeal.

- State your opinion of the fee simple market value of the property. This field is required if you are appealing based on the assessment exceeding market value.

- Select the grounds of your appeal. You should check one or more boxes that correspond to the reasons you believe the assessment is incorrect.

- If appealing under grounds related to exemption, enter the exemption type and amount you are claiming.

- Sign the form to confirm your information. Print your name and date the document.

- Indicate your status as either the property owner or taxpayer, representative, or person under contractual obligation by checking the appropriate box.

- When completing the form, ensure that all required fields are filled out. Double-check for accuracy to avoid any delays in processing.

- Once all sections of the form are completed, you can save your changes, download a copy for your records, print it, or share it as needed.

Complete your HI BFS-RP-P-51 document online today to ensure a smooth appeal process.

Paying Oahu Property Taxes The first installment is due on August 20 (includes taxes from July 1 to December 31), and this bill will be mailed in July. The second installment is due on February 20 (includes taxes from January 1 to June 30), and this bill is mailed in January.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.